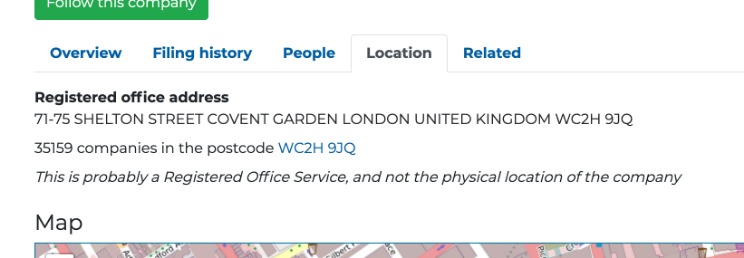

This can save money if you have an address you can use in one of these locations. Once you’ve identified the business type you’re going to register, you need to choose a location for your company. For some, this means a brick-and-mortar building in or around your city. With so many businesses forming solely online, you may just use this location for tax purposes and where your correspondence arrives. You can usually get a registered agent when you use an LLC formation service to file for your LLC. Registered agent services are always available to handle documents in a timely manner to avoid penalties you could otherwise face. Business registration in the US may seem like a challenge, but the process is actually quite simple.

Several states – Delaware, Nevada, and Wyoming – have laws that favor businesses. Delaware doesn’t tax out-of-state income, while Nevada and Wyoming don’t tax any business income.So it’s tempting to register an LLC in one of those states when forming an LLC.

However, when the place of business incorporation is different from the location of the business’s establishment, you need to register your business with the state authorities separately. Such separate registration is not required when incorporation and establishment of business are in the same state. The decision requires a cost-benefit analysis of various options. For non-residents setting up a US company, you are required to obtain an EIN (Employer Identification Number), pay all the taxes and other due tax, file paperwork with the IRS and state authorities. It is possible to do this yourself but it is highly advisable that you have an accountant handling it for you at least in setting up your LLC or corporation. Corporate bylaws are typically much longer and more detailed than the articles of incorporation.

Essentially, the EIN is a federal tax ID number that functions as a Social Security number for your business. Having an EIN allows your business to open a bank account and apply for bank loans, hire employees, pay taxes, and more. Consider an example of a corporation being assessed net income tax. Then, with after-tax proceeds, it makes a taxable distribution to a shareholder. This shareholder now has taxable income on funds that have already been assessed a tax liability. Another primary difference between legal entities and one of the most important reasons a company may want to incorporate is for the advantage of issuing stock.

Choose a State For Business Registration

You will also have access to our video with our U.S. tax attorney on U.S. tax responsibilities. Virtual Premium Address, Scan Sales Tax Permits, Merchant Statements & Other Virtual Business Mail for Timely Execution. Receiving your Sales Tax Registrations, Late & Demand Notices, or Merchant Chargebacks late, or not at all, leads to massive unnecessary costs to your business. A U.S. company would instead work with another U.S. company due to fewer legal issues and a higher trust level. Help your business grow in the U.S. and take advantage of these joint venture opportunities. • Protect your assets (an e-commerce business in your home country) from devastating lawsuits. Corporations have the unique ability to raise capital by issuing shares of stock.

Should I choose an LLC or a C Corp?

You just have to pick one from your criteria of price and features. Read more about Open a company in the US here. You can get started as quickly as now and even opt for their money-back guarantee if in case you don’t like their service.

Structure

A corporation will generally have more formal record-keeping and reporting requirements than an LLC. Here are answers to some common questions you may ask yourself when determining if forming a corporation is the right move for you and your business. Bylaws are written rules that determine how your corporation will be governed. Read more about USA company registration here. It’s best to get help from an experienced small business lawyer who can tailor the shareholders’ agreement to your company’s specific needs.