Understanding How PDF Fraud Works and Key Red Flags

PDF documents are widely trusted because they preserve layout and appear unalterable, yet that perceived immutability is often exploited. Fraudsters manipulate PDF content, metadata, and embedded objects to create convincing forgeries such as altered contracts, counterfeit invoices, and bogus receipts. Awareness of common tactics makes it possible to spot anomalies before they cause financial loss or reputational harm.

One primary vector is simple content alteration. Text can be edited, deleted, or layered over using image overlays so that a visual inspection appears legitimate while the underlying data differs. Another tactic is metadata manipulation: authorship, modification dates, and software timestamps can be changed to create a false history. Embedded fonts and images may be swapped to mimic branding or official seals. Hyperlinks embedded in PDFs can redirect to phishing sites while appearing to link to legitimate domains. Digital signatures can be removed or recreated in a way that visually resembles a signed document but lacks cryptographic validity.

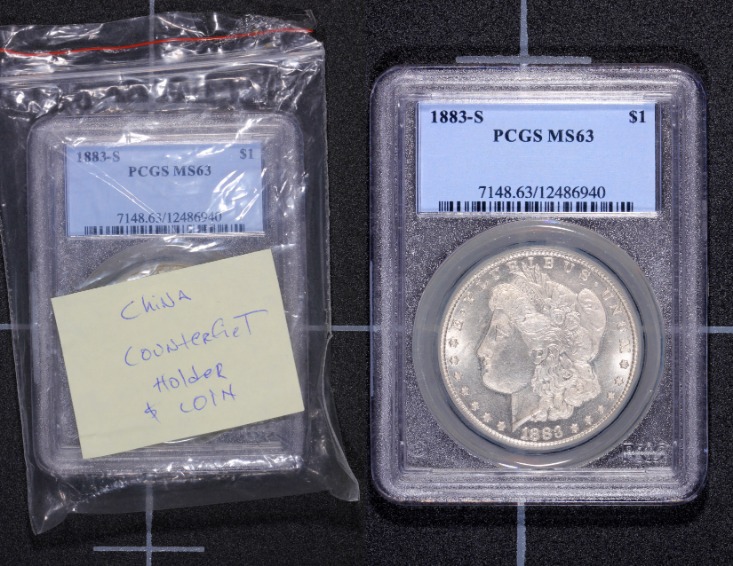

Key red flags include inconsistencies between visible content and metadata, mismatched fonts or logos, unusual file names or sizes, and suspicious edit timestamps—especially when modification dates postdate the claimed issuance. Pay attention to financial details: line items that don’t sum correctly, rounding errors, inconsistent tax calculations, or vendor details that differ slightly from known records. A combination of visual verification and technical checks yields the best detection results.

Using visual inspection alongside forensic checks—such as verifying embedded fonts, layers, and image compression artifacts—helps uncover subtle manipulations. When a document is expected to carry legal or financial weight, insist on verifiable electronic signatures or cross-checked metadata. Training staff to recognize common patterns of PDF fraud reduces the chance of a single altered file causing systemic damage.

Technical Methods, Tools, and Best Practices to Detect Fake Invoices and Receipts

Detecting fraudulent PDFs requires a mix of automated tools and human review. Start with basic validation: open the file in a trusted reader and inspect document properties for author, creation and modification dates, and software used. Use dedicated forensic utilities to extract and analyze metadata, embedded object lists, image layers, and font tables. Cryptographic signatures must be checked against issuing certificates; a visible signature alone does not guarantee authenticity unless the signature verifies successfully using an established certificate chain.

Automated pattern analysis accelerates detection. Machine learning and rule-based systems can flag invoices and receipts with unusual vendor names, abnormal totals, or uncommon line-item descriptions. Transactional anomaly detection compares incoming invoices to historical averages for frequency, amounts, and vendor behavior. For organizations with frequent payments, integrating document validation into the payment workflow reduces risk—documents that fail verification trigger manual review before funds are released.

Practical steps include validating contact details and bank account numbers directly with known vendor records, checking for duplicate invoice numbers, and confirming purchase order references. Cross-referencing a suspicious file using a specialist service can also be effective; for example, a quick automated check at detect fake invoice can reveal metadata tampering or signature issues. Strong controls such as two-person approvals for high-value payments, whitelisting trusted vendors, and enforcing multi-factor identity verification for supplier changes reduce opportunities for fraud.

When reviewing receipts, inspect for photo-editing signs like inconsistent shadows, mismatched resolution between logo and text, or uneven compression artifacts. For invoices, scrutinize bank details for slight alterations in digits or domain changes that could redirect payments. Combining technological checks with process controls forms a resilient defense against most common PDF-based scams.

Real-World Examples, Case Studies, and Response Workflows

Case studies illustrate how simple manipulations can yield substantial losses. In one incident, an organization received a seemingly routine supplier invoice with a slightly altered bank account. The invoice matched historical formatting and contained plausible line items, but an automated validation flagged a change in the IBAN checksum. The attempted payment was halted, averting a six-figure loss. In another case, a scanned receipt was edited to inflate reimbursable expenses; close inspection showed compression mismatches and repeated patterns in the background that betrayed copy-paste edits.

Practical detection workflows used by security teams often follow the same pattern: intake → automated validation → manual forensic review → vendor verification → approval or incident escalation. Intake should capture original emails, headers, and attachments to preserve context. Automated validation covers metadata, signatures, and basic anomaly detection. Documents that fail automated checks are escalated to a forensic reviewer who examines layers, embedded objects, and image inconsistencies. Vendor verification involves contacting a recognized company representative using previously stored contact information, never using contact details supplied in the suspicious document.

Training and case-based learning increase detection rates. Regular simulated fraud exercises expose staff to realistic manipulations and teach them to follow escalation protocols without delay. When fraud is detected, preserve all original files and communication, notify legal and finance teams, and consider involving law enforcement when financial theft or identity misuse is evident. Post-incident analysis should update vendor validation rules and improve tooling to catch similar attempts in the future.

Adopting a combination of strong process controls, technical validation tools, and continuous training creates a layered defense against attempts to detect fraud in pdf, spot a fake receipt, or uncover a sophisticated fraud invoice. Regular audits and investing in proven detection services reduce exposure and make it much harder for fraudsters to succeed.